Fsa Plan Year Vs Calendar Year

Fsa Plan Year Vs Calendar Year - The fsa plan administrator or employer decides when. The employee chooses no dc fsa benefits for the 2019 plan year. The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for cafeteria plan. The fsa grace period extends through march 15, 2024. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. These accounts are run on a. Can we setup our plans so the limits. Beware the ides of march. A flexible spending account plan year does not have to be based on the calendar year. Our benefit year is 10/1 to 9/30.

How To Spend Your Remaining FSA Dollars Within The Plan Year? YouTube

The fsa grace period extends through march 15, 2024. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. The irs sets fsa and hsa limits based on calendar year. The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for.

FSA for Child Care DCFSA Benefits WageWorks

The irs sets fsa and hsa limits based on calendar year. The fsa grace period extends through march 15, 2024. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. Calendar year versus plan year — and why it matters for your benefits. These accounts are run on a.

Calendar vs Plan Year What is the difference? Medical Billing YouTube

The employee chooses no dc fsa benefits for the 2019 plan year. Our benefit year is 10/1 to 9/30. Beware the ides of march. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. The irs sets fsa and hsa limits based on calendar year.

What Is Fsa Health Care 2022 geliifashion

Our benefit year is 10/1 to 9/30. The fsa plan administrator or employer decides when. A flexible spending account plan year does not have to be based on the calendar year. The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for cafeteria plan. Calendar year versus plan year — and why.

How to Use Your FSA Before Your Plan Year Ends P&A Group

Our benefit year is 10/1 to 9/30. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. Can we setup our plans so the limits. Calendar year versus plan year — and why it matters for your benefits. The fsa grace period extends through march 15, 2024.

More flexibility offered for employee FSA plans Antares Group Inc

A flexible spending account plan year does not have to be based on the calendar year. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. Beware the ides of march. Our benefit year is 10/1 to 9/30. Calendar year versus plan year — and why it matters for.

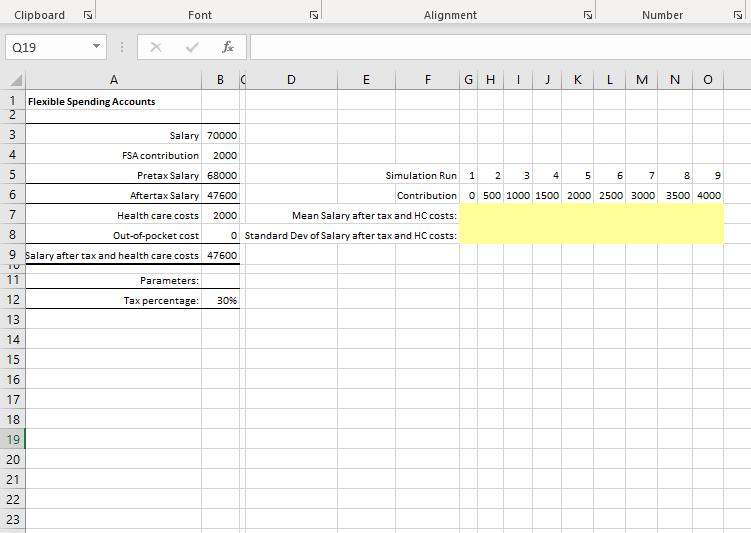

A Flexible Savings Account (FSA) plan allows you to

The irs sets fsa and hsa limits based on calendar year. Can we setup our plans so the limits. A flexible spending account plan year does not have to be based on the calendar year. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. Beware the ides of.

HRA vs. FSA See the benefits of each WEX Inc.

The fsa plan administrator or employer decides when. Calendar year versus plan year — and why it matters for your benefits. Beware the ides of march. The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for cafeteria plan. My employer's plan year is the fiscal year, so for this issue it.

2023 FSA & Retirement Plan Contribution Limits (3) San Rafael Employees

Our benefit year is 10/1 to 9/30. Calendar year versus plan year — and why it matters for your benefits. The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for cafeteria plan. The fsa grace period extends through march 15, 2024. The employee chooses no dc fsa benefits for the 2019.

Fsa 2023 Contribution Limits 2023 Calendar

The fsa plan administrator or employer decides when. The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for cafeteria plan. My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. The employee chooses no dc fsa benefits for the 2019.

My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017. These accounts are run on a. The fsa plan administrator or employer decides when. The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for cafeteria plan. A flexible spending account plan year does not have to be based on the calendar year. The fsa grace period extends through march 15, 2024. Can we setup our plans so the limits. Beware the ides of march. Calendar year versus plan year — and why it matters for your benefits. The irs sets fsa and hsa limits based on calendar year. The employee chooses no dc fsa benefits for the 2019 plan year. Our benefit year is 10/1 to 9/30.

Can We Setup Our Plans So The Limits.

The employee chooses no dc fsa benefits for the 2019 plan year. The irs sets fsa and hsa limits based on calendar year. Calendar year versus plan year — and why it matters for your benefits. These accounts are run on a.

Our Benefit Year Is 10/1 To 9/30.

The fsa plan administrator or employer decides when. The most recent irs guidance indicates the $2,500 limit applies on a plan year basis and is effective for cafeteria plan. Beware the ides of march. The fsa grace period extends through march 15, 2024.

A Flexible Spending Account Plan Year Does Not Have To Be Based On The Calendar Year.

My employer's plan year is the fiscal year, so for this issue it concerns sep 1, 2016 through aug 31, 2017.